I continued the work on moving topsoil during the rain Sunday afternoon. All of the topsoil is now moved and the rains continued and got harder. The rain is supposed to continue all week, so I am praying that all my topsoil doesn't get washed away. The good news is that the area doesn't get hit hard by rains due to the tree cover. Here is a picture of the area with all the topsoil moved now:

The next phase of Anna's playplace is to put down a weed barrier.  At the cheapest level, weed barriers are simply plastic like in trash bags that cover the ground. There are problems with the cheap weed barriers, including what happens to water. The expensive ones are puncture resistant and allow water to flow through easily as well as last for a long time. Since I was covering a relatively small area, 13.5' x 12.5', I decided to go for an expensive weed barrier. I choose the Easy Gardener brand Commercial Grade Weed Block which came in a package 4' x 50' and ran about $20. Since it has to overlap. this ended up being about the perfect size. I can cut four strips of 12.5' long and overlap the four feet about 9" each sheet. I also bought about 40 garden stakes to pin the weed barrier down.

At the cheapest level, weed barriers are simply plastic like in trash bags that cover the ground. There are problems with the cheap weed barriers, including what happens to water. The expensive ones are puncture resistant and allow water to flow through easily as well as last for a long time. Since I was covering a relatively small area, 13.5' x 12.5', I decided to go for an expensive weed barrier. I choose the Easy Gardener brand Commercial Grade Weed Block which came in a package 4' x 50' and ran about $20. Since it has to overlap. this ended up being about the perfect size. I can cut four strips of 12.5' long and overlap the four feet about 9" each sheet. I also bought about 40 garden stakes to pin the weed barrier down.

If this week lightens up on rain, I will be ordering 2 cu yds of playground mulch and getting the project finished. Meanwhile, in the areas around the play place I am fertilizing and planting grass. Since we are in a drought, the rain will provide the opportune moisture to get my grass started growing. Hopefully the area will be completed by this weekend.

Monday, March 31, 2008

Part 2 of Anna's playplace

Posted by

Erik Burckart

at

9:04 AM

0

comments

![]()

![]()

Labels: Anna, Landscaping, Projects

Sunday, March 30, 2008

Back-breaking project -- Anna's play place

I have a cool project I am in the midst of at our house, too bad I woke up this morning with a sore back from it. In our backyard as you come off the deck, we used to have a brush pile and a bunch of trees. We had to get rid of the largest pine and while they were at it, the tree company offered to take away our brush pile. We gladly let them take this away and instead of piling more debris there, we decided the area made for a perfect play place for Anna as its shaded and close to the deck. At the same time, we decided we would reclaim some of the existing "garden" and make it into more grass in the back yard.

The problem is that the area is still covered with a layer of leafy mulch, no thicker than three inches. The area was also not as level as we like. Further, we couldn't see the area because of some overgrown bushes. Yesterday, I started to tackle all of these issues.

First thing yesterday morning, I moved the bricks delineating our garden and exposed more of what was declared garden to the "grass" side. I then spread out the leafy mulch, more evening the land. The land with leafy mulch on it was too soft in general and it would need covered in dirt to solidify the ground while the leafy mulch decomposes, much like how a landfill works but with less dirt. Then I hacked back the bushes at the end of the deck, too much from Heather's viewpoint, but in a way that hopefully should allow them to grow back and us to have a better view of Anna's new play place. This generated so much debris that I had to call John over to bring his truck and help me take it to the landfill.

By the time I got back, I had to take a break because it was raining and there was about to be a baby shower at our house, meaning I needed to clean up and be ready to take care of Anna. While the ladies were downstairs at the baby shower and Anna was asleep, I called and ordered 3 cubic yards of topsoil from Mulch Masters to put over this area. Around three hours later, the topsoil shows and I had my large pile of topsoil. Our guests left around 5 PM and I took advantage of the remaining daylight and lack of rain to start moving topsoil. I got about one and a half hours of moving topsoil in before the rain started again, but I feel good about the progress that was made. I took this picture this morning:

On the right you can see the light grey bricks with the new delineation of the garden. Everything between those 4 trees, about 12.5' X 13.5' will become Anna's playplace. The remaining area thats not grass will be covered in topsoil and have grass planted on it.

Once I finish moving the topsoil, I plan to cover Anna's area with a weed barrier and then playground mulch. We then hope to get some of the plastic play structures like this to put in there:

We still have a lot of work to do, but I plan to track some progress here :-)

Posted by

Erik Burckart

at

7:10 AM

0

comments

![]()

![]()

Labels: Anna, Landscaping, Projects

Friday, March 28, 2008

Maxed Out - American Economy's Credit Woes

I wanted to see the documentary Maxed Out on the American Economy's Credit problems, too expensive houses, cars, way of living, and the effects it has on people. It was eye opening and worth watching. The good news is, you can apparently see it for free on Google Video here. I recommend checking it out.

Maxed Out as a documentary was very well done although I am not sure I agree 100% with the direction they took on it. They did not blame consumers or lifestyle creep as much as I think needs to be blamed. Instead, they seemed more prone to blame cost of living, the banks for offering credit and loans, and the government for not stopping the banks. For example, they point out that people have less money today than they did in the 1970s if you cost-adjust things for inflation. While that might be true, people are tending to live more lavishly than they should be as well.

As my friend Aaron said, "The system is set up for people to fail, but still, if [those people] could do basic math they should know that."

Speaking of lifestyle creep, its interesting that many of my friends tend to live in or purchase houses that are larger than those they grew up in. Are we more successful than our parents or more in debt? I think its a little bit of everything, interest rates back in the 1980s and 1990s were less, some of our parents maybe weren't as successful, now many more people do 100% financing and are more in debt, and finally I think that the new houses these days are built larger for less money but done so also with less quality.

All that said they do point out that the government debt is astonishing and needs to be taken care of, a point that a fiscal conservative such as myself wholeheartedly agrees about.

Amortization schedules show the real problem

Financial Advisors love to flaunt the power of compound interest, that is the amount of interest money can earn over time when you earn interest on the principal and interest that exists. If you look at an amortization schedule, you will see the opposite, almost a negative compound interest thing happening.

First, an example. Using an Amortization calculator and Freddie Mac's current weekly average mortgage rate of 5.85% on a 30 yr loan starting in April of let's say $150k, you will find I would pay off the first half of principal in February of 2029 making the minimum monthly payment. Thats almost 21 years to pay off $75,000 at almost $900 per month! By the end of 30 years, the total interest paid is over $168k!

While changing the principal doesn't change when you pay off half, your interest rate does. If you have a higher mortgage rate, lets say 7%...you pay off half in December of 2029. So, when you pay off your first half of your mortgage varies from about 20-22 years based on the current interest rates.

Now, in the past people have paid little to no attention to these schedules. Its because paying off principal wasn't an issue when houses were growing at 4% compounded annually. But, with the recent housing market growth slowdown, I hope that more people pay attention to it. If someone gets a 100% financed $150k house now and prices only go up 1% per year for the next 3 years and then they try to sell it, they will have paid off roughly $6.5k in principal and gained about $4.5k in value on their home. So, if they sell it at that $154,500 with a standard Realtor fee of 6%, they will pay $9,270 in Realtor fees. This will leave them with a whopping $1,730 check for paying $32,400 in mortgage payments not including PMI, homeowners, and taxes. Sure, they will also have got a small tax deduction during that time...but I think they might have been able to rent and save more money.

Just as a matter of opinion, look at your amortization schedule and consider dropping some more money into your mortgage monthly. Maybe you can pay off the first half a bit quicker than in 20 years then :-)

Thursday, March 27, 2008

Steelers decide picking Booger a bad idea

I couldn't resist the title based on these headlines. The Pittsburgh Steelers signed Anthony "Booger" McFarland then choose not to keep him after he flunked a physical. Maybe the Booger will be picked elsewhere.

Posted by

Erik Burckart

at

11:10 AM

1 comments

![]()

![]()

Wednesday, March 26, 2008

Savings Account Interest Rates keep getting slashed

Wow...this week my savings account at HSBC had its interest rate slashed once again. Here is part of the letter entitled "A Personal Message from Our Executive Vice President regarding Your HSBC Direct Account."

In these challenging times, having a savings plan is more important than ever. At HSBC Direct we are committed to helping you with your savings goals by providing the best rate we can.

As you are undoubtedly already aware, there has been a general trend of reducing interest rates in the U.S. market over recent months. These changes have been influenced by the Federal Reserve moving its target interest rate down in response to developments in the economy and financial markets. Last week the Federal Reserve again reduced this key rate, by 0.75% to 2.25%.

At HSBC Direct we review our rates regularly in the context of market conditions, the federal funds rate and the overall economic environment to ensure we are providing you a competitive rate at all times. Following a further review of all of these factors, we have reduced our Online Savings Account rate by 0.50% to 3.05% APY* effective 3/20/2008.

I wonder what makes this message "personal?" Later, Mr Kevin Martin, the supposed author of this email, states:

The good news is, you’re still getting a competitive rate — 7x the national savings average.

Well, gee Kevin...that is great news! When I signed up for HSBC Direct it was the promise of 5.05% interest rates that had me create an account. Meanwhile, I am paying 5.875% on my mortgage to your company. Since you dropped my interest rate down 2% now, can I have a 2% drop on my mortgage interest rate in the name of fairness? How about just a 1%? Since there is a "a general trend of reducing interest rates in the U.S." I think I would like to join in this trend with my debt as well :-)

Unfortunately, HSBC is still #3 on the bankrate.com list for savings account interest rates in my area. All I know is that HSBC is not gaining my customer loyalty through their continuous reaction to the market. I guess I would have been liked to been told at the beginning that the interest rate was going to track near to the fed's rate directly. That way a fed rate increase would allow me to immediately also see an increase in my savings percentage.

Posted by

Erik Burckart

at

10:26 AM

0

comments

![]()

![]()

Labels: Banking, Bankrate.com, HSBC, Saving

Of Car Seats and Strollers

Heather and I have been more intensely researching and purchasing baby items now. With Anna, we were much more aggressive in purchasing but with our next little girl, we had many of the things we needed. We have thus far bought a BOB Revolution Duallie and a Maclaren Twin Techno stroller.

After having purchased the car seat adapter for the BOB, we now are considering what to do about getting a car seat that fits. See, we have the Chicco KeyFit Car Seat and only the Graco SnugRide, Graco SafeSeat, Peg Perego, and Britax Companion car seats fit in the BOB car seat adapter. At first, we both thought, let's just buy a second car seat for our second car and be able to use that also in the BOB stroller. But, one glance at the Consumer Reports Infant Car seat ratings last night and we both agreed that wasn't best. Why? Because our less than 2 yr old Chicco KeyFit car seat scored a whopping 88 out of 100 on their ratings while the next closest was the Britax Companion at 77 and Peg Perego at 76. The Gracos were further down the list with the SnugRide at 74 and SafeSeat at 72. The Chicco was the only car seat to score above a 77 and it did so with an 88!

So, our plan changed. We probably will borrow/buy a new KeyFit base for the second car and borrow/buy a used Graco SnugRide just for the couple months its needed with the BOB.

As for the Maclaren, it claims to support newborns and using Viewpoints, I was able to verify that this actually works.

Posted by

Erik Burckart

at

6:31 AM

2

comments

![]()

![]()

Labels: baby, car seats, consumer reports, strollers

Monday, March 24, 2008

Happy late Easter!

Its a day late, but Happy Easter! As my last post pointed out, Heather and I spent our Easter weekend in Ponte Vedra as has been her family tradition since before Heather was born.

As of yesterday, Heather is 35 weeks pregnant and looking/feeling great. Since she was so far along in her pregnancy, we decided to fly instead of drive since her doctor wanted us to stop every 90 minutes for her to stretch if we drove. We took Express Jet direct from Raleigh to Jacksonville, Florida. Based on this one experience, I highly recommend Express Jet. They give you a healthy meal and drink on every flight with $1 beers and $3 wine and XM radio to entertain you. They are also cheaper than their competition. We enjoyed it.

When we got into Jacksonville airport, we picked up the car we had rented through Hertz. Thinking, I don't want to carry down the car seat, we rented one for about $30 for the 4 days we had the car. One thing that I found difficult was that the car seat was just tossed in the back. It looked as if it had just been cleaned (it was covered in plastic) and it was a Graco which I had no experience with. So, in the parking garage (the rental cars in Jacksonville are across the street in a parking garage) I had to figure out the new car seat and the car. It took me about 15 minutes since it was a Toyota Corolla (which Hertz claims is a mid-size car like a Mazda 6?) which I am familiar with and the car seat was already set up for Latch and Tether. I used Latch and Tether as well as seat belt just to be safe.

Is it too much for the rental car company to put in the car seat? Is it for liability reasons? Frankly, I would be tempted to sue them anyway was something to happen to Anna and the car seat found to be the problem. Why? Two reasons. 1) It was an old car seat. 2) They put me in a situation where I could not have the same success I can at home. I don't know the car seat or car....also, here in Raleigh, the fire stations check the car seat installations for you and will ensure they are properly in. Without having any experts available to check, they are putting me at a disadvantage and charging me for it.

Ponte Vedra was great once again as was spending time with Heather's extended family. I hope you all also had a great Easter!

Posted by

Erik Burckart

at

3:56 PM

0

comments

![]()

![]()

Labels: Easter, Family, Ponte Vedra, Vacation

Wednesday, March 19, 2008

Ponte Vedra Beach Resort

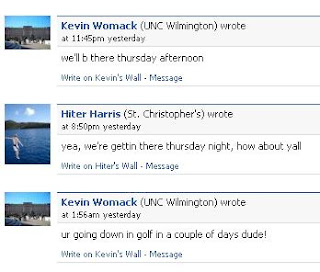

Heather's family has been staying at the Ponte Vedra Beach Resorts just south of Jacksonville Florida for the past 30+ years every Easter. The resort lists the event as their family reunion...but in reality it is so much more than that. Heather's family spends time together through this interaction in a way that I can only hope we are able to maintain throughout the years. The different families spend time together intentionally and that has led to a lot of fun interactions. You can see my brother-in-law Kevin trash talking my 16 year old cousin, for example, on Facebook.

As a kid, we didn't have family reunions. Sure, we got together with family consistently at Christmas or Easter...but those were often just a short lived couple of hours. I fondly remember a family reunion of sort with my mom's side of the family as we all got cabins somewhere and spent time together. I remember playing basketball with my Uncle Paul...but that was now so long ago. Unfortunately, through moving away from Pittsburgh I have lost touch with so much of my own family. The only one I still keep in touch with is my Uncle Paul, who since Anna was born has visited us about four times. In the past couple days, my Aunt Carol and I have again been in touch exchanging emails. Beyond that, there is no and never has been to my knowledge significant regular time spent together.

Heather's family is fortunate to be able to spend that time together. Most of Heather's father's siblings and their families spend Thursday to Monday every Easter at Ponte Vedra. Since I have joined the family, they have done nothing but welcomed me into their family and treated me like I belonged there. We always look forward to this trip every year and I am happy that the time has come again this year. What is really neat is that Heather's cousins are some of the closest family we have. Two of her cousins have been having kids at the same time as us. You can see pictures of Heather's cousin Lauren and daughter Katrinca visiting when Anna was young and was the catalyst for her beginning to crawl. We also visited them this past November and had a great time. Another cousin has lent us maternity clothes and gear like a playmat and excer-saucer.

Ponte Vedra is not the only time we spend with Heather's extended family. We used to see them at Thanksgivings and Christmases, although since her grandfather passed on that does not happen anymore. Since then, there is a big gathering every New Year's. Also, the female aunts and cousins all go to NYC every summer together and see a show and shop. We also have traveled to Europe together and some of the other family has traveled to New Zealand and other places together. But, none of those are as significant as Ponte Vedra. I am not sure those trips would happen without Ponte Vedra as I really believe that these relationships would not be nearly as strong if this "family reunion" at Ponte Vedra did not happen every year. This is why we really look forward to it and why we are thrilled to be there once again this Easter.

Posted by

Erik Burckart

at

6:18 AM

0

comments

![]()

![]()

Tuesday, March 18, 2008

Tonight's date night with Anna

Tonight, Anna and I ate at the delicious Andy's Cheesesteaks and Cheeseburgers. Then, we took a trip to Target to return a bathing suit and buy some goodies for our upcoming trip and plane ride. We bought Crayola color wonder markers and paper, a beach ball, and a portable DVD player.  Last time we flew, we used Heather's laptop to play movies for Anna. Her laptop was just too large with Anna in a confined space. The good news is I got the DVD player at $40 below the price it was listed at because of an incorrect sign. But, based on the ratings that this product has on Target.com...do we open it or return it? The product has an average guest rating of 2 stars out of 5 and out of 13 reviews, got 3 good reviews, 2 ok reviews, and 8 bad reviews. Not sure what to do...

Last time we flew, we used Heather's laptop to play movies for Anna. Her laptop was just too large with Anna in a confined space. The good news is I got the DVD player at $40 below the price it was listed at because of an incorrect sign. But, based on the ratings that this product has on Target.com...do we open it or return it? The product has an average guest rating of 2 stars out of 5 and out of 13 reviews, got 3 good reviews, 2 ok reviews, and 8 bad reviews. Not sure what to do...

Interestingly enough, all the inexpensive (<$100) portable DVD players at Target have horrible ratings. So, perhaps its just that expectations are too high?

Posted by

Erik Burckart

at

8:16 PM

2

comments

![]()

![]()

Labels: Anna, date nights

Monday, March 17, 2008

Emergency Funds

I have been thinking a lot lately about our emergency fund. I have heard people say two things, "3-6 months salary" and "3-6 months living expenses." Most will admit that the more risky your income is, such as if you are purely on commission or a contractor, you should have closer to 6 months instead of 3 months. I think that the living expenses is the best way to go, since its not important to continue saving when you have such an emergency. But there are other factors I have been thinking about...

1) Include money to break out of contracts. Some of our monthly expenses are contractual and it takes some money to break out of those contracts. For example, my Sprint PCS 2 year contract has a fee of $250 to break out of it. Our pool contract does not allow you to break out of a given year's payments unless you sell your home. If you lost your job and are having problems finding a similar paying job, you may need money to break out of the contracts so that your new budget does not have to have those large expenses.

2) Know that COBRA will raise the cost of health care. Trying to find the typical cost of COBRA, I found one article claiming it was $1498 per month and another claiming $600 per month for a family. Frankly, I trust Bankrate.com and the second article more.

3) Continue to save for car expenses at a lower rate. If you don't have a car loan and are saving to pay cash for your cars, you should continue to save for that next car but perhaps at a much lower rate. While retirement, college savings, and investments should probably be slowed, your car is still a ticking time bomb. Do you need as nice of a car as you were saving for? Perhaps not.

Posted by

Erik Burckart

at

9:19 AM

0

comments

![]()

![]()

Sunday, March 16, 2008

Breakfast at the Burckarts

Breakfast here has gotten pretty predictable for Anna and Heather. Anna eats a banana and a half of a waffle while drinking her milk. Heather has also been eating waffles and cannot drink juice since Anna will want it. :-) So, since everyone has been enjoying my waffles, I thought I would put down my recipe here. We make these waffles and store them in the freezer in a big zip lock bag. When Heather or Anna go to have some, they just take them out of the freezer bag and put them into the toaster oven. Here is my recipe:

3 egg yolks

3 cups skim milk

3 cups all-purpose flour

1 and 1/2 tbsp of baking powder

3/4 tsp of salt

1/2 cup of vegetable oil (under if anything)

1 tbsp honey

1 tsp cinnamon

Mix all that together in a large mixing bowl.

Stiffly beat 3 egg whites in a separate bowl. Fold that into the mixture in the larger bowl.

Make your waffles. If you are freezing, let them cool and put them into a ziploc freezer bag (gallon size will be needed). Make sure you take out the air in the bag to keep out freezer burn.

Posted by

Erik Burckart

at

7:42 AM

1 comments

![]()

![]()

Wednesday, March 12, 2008

Buy Last Year's Baby stuff brand new discounted

For those of you who are not "in the know" about this deal for whatever reason, you can buy last year's model stroller, high chair, etc for steeply discounted prices. There are many sites that offer these older models for good discounts. Heather and I just purchased a 2007 brand new stroller for $110 less (27.5% off!) than Babies"R"Us offers from a site called Baby Dealz. Yes, the "z" in "Dealz" is sort of lame and the site may not be as spiffy as Babies"R"Us or Target...but the prices are phenomenal. Also, we got free shipping on our stroller, ordered it Sunday and it arrives today according to UPS. And, since the site accepted PayPal, I didn't even have to worry about them having my financial info. Also, they are a Yahoo! store which helps me trust them a bit more. In this case, it seems to have worked out...although I won't know for sure until we get the delivery later today.

One thing I have noticed about these deals is that they get worse as the companies have less stock. You can see on Baby Dealz that some of their 2006 models are less discounted than the 2007, and some of the 2007 colors are more discounted than others. I assume this all depends on how much stock they have of a particular product. So, I am guessing the best buys come when their stock is at its peak which would be shortly after the new models come out.

Other sites I have browsed (but never bought from) that I keep links to include:

Best Buy Baby

Albee Baby

BabyRide.com

CSN Baby

D!mart stores

Posted by

Erik Burckart

at

7:43 AM

0

comments

![]()

![]()

Monday, March 10, 2008

Sunk Cost Dilemma -- "Live like no one else today..."

"... So you can live like no one else tomorrow." Is a good quote used often by Dave Ramsey. I am not sure if he originated it, but I do like it. Dave Ramsey is one of the most vocal anti-debt voices out there in the world. What amazes me is that those who are vocally anti-debt like myself, are often those who were on the brink of serious financial disaster at some point. But some who were there get right back in debt.

My new theory is that there are two reactions to being close to financial ruin, fight back and change your ways completely or do just enough to survive another day. Those who fight back are often the ones who change their lifestyle enough to pull out of debt and if it was a serious amount of debt, they did that long enough that they hate debt if for no other reason but because they had to live a very limited lifestyle while getting out of debt. Every financial adviser has a similar blueprint as to how to get out of debt which goes something like this:

1. Establish a budget that minimizes expenses and maximizes debt payments.

2. Save a $1000 emergency fund so you don't pile emergencies on credit cards.

3. Pay off unsecured debts using either the debt snowball (smallest first then put all that money on the next largest) or by paying off the highest interest rates first.

This simple formula can be seen in the Wall Street Journal, Washington Post, New York Times, USA Today, by Financial Advisers like Fidelity Investments, by Dave Ramsey, and through ministries like Crown Financial Ministries. Whats amazing is the difference of what you do afterwards. Do you pay off secured debts or not?

Secured debts are those which have some backing collateral, like a car or a house. The difference between some of the advice and others is whether they suggest you pay off secured debts to eliminate the risk of debt in your life or not. The aggressive financial adviser wants you to start pouring the money into their service and quickly will point out that you can get a higher rate of return (they may quote anywhere from 8-14%) from mutual funds than your interest rate on your secured debt (4-7%), so its not important to dump the extra money into your secured debt. Others, like Dave Ramsey and Crown would point out that this is known as the sunk cost dilemma.

The sunk cost dilemma is an economic principle that points out that people who have already committed to one path (like paying a car loan, student loan, or mortgage) will choose to stay on that path rather than review if this really makes sense. For example, would you borrow against your house to put the money in the stock market? If so, you are a big risk taker, most would not. Well, this is essentially what you are doing with a mortgage if you are putting money into the stock market instead of paying off your house.

Dave Ramsey and Crown would also point out Proverbs 22:7, "The Borrower is slave to the lender."

The bottom line is, "Live like no one else today." Don't fall prey to the sunk cost dilemma. Pay off the secured debts as well. Then, when you have no debt and can pay yourself a lot more, you will "live like no one else tomorrow."

Posted by

Erik Burckart

at

7:50 AM

0

comments

![]()

![]()

Labels: Crown Ministries, Dave Ramsey, debt, Finances

Saturday, March 08, 2008

Yay rain!!!

We are in desperate need of rain...and finally getting some. Yay rain! According to the WRAL Drought Monitor, we are still 8" behind on rain since January 1, 2007. Falls Lake, which is Raleigh's water source, is finally catching up due to a soggy week. As you can see from these Lake level graphs, the lakes are now up above where they were in September...but not where they need to be to be out of the drought. According to this page (chart shown above) on the lake levels, Falls lake is at 247.3 ft and normally should be at 251.5 ft.

As for us, we are praying the rain keeps coming. Anna is ready in her raincoat:

Posted by

Erik Burckart

at

4:43 PM

0

comments

![]()

![]()

Friday, March 07, 2008

Gaucho Restaurants in London

This past week I took a 5 day vacation with my brother-in-law Kevin to London during his Spring Break. We had a great time. The most significant and amazing thing to me was this meal I had at Gaucho Restaurants. Gaucho is an Argentinian Restaurant. We went to the one around the corner from our hotel, Le Meridien Piccadilly to the Gaucho Piccadilly. We found this restaurant thanks to the Frommer's London Day by Day guide who listed this as the best beef and was a very close restaurant to our hotel.

Unfortunately, we didn't have reservations but thanks to the fact we came on a Monday night and early for those in the UK (7 PM), we were welcomed in to sit right next to the main cook and watch him behind the glass. It may sound like an ideal seat until you realize how hot it was. The cuts of beef were fabulous and watching this guy cook 20-30 steaks/filets at a time with fish, chicken, and lamb was amazing. I ordered the Bife de Lomo, which was their tender filet. I ordered a 400g medium, my standard when not knowing what to expect and since I was having trouble figuring out the sizes combined with a hunger from walking nearly 10 miles in 2 days plus only eating a ham and cheese sandwich since breakfast. Needless to say now that I can do the conversion, it was the biggest filet I ever had. I watched the chef cook my steak, very slowly as all of their steaks are cooked. It was amazing to watch him manage so many steaks and doing them to order purely by feel, no temperature taking here.

When I got the steak, I cut into it and saw that it was very red. By looks alone, it was definitely a medium rare if not rare. But, I then noticed there was no blood coming out...my plate was clean. I tried a bite and the steak melted in my mouth, no chewiness for it being so red, and it was warm throughout. The steak was marvelous, I enjoyed bite by bite but unfortunately could not finish it all as it was enormous. Both Kevin and I were amazed at the steaks, the flavor and perfection, and were both sure that this was the best steak either of us have ever had.

The one thing that lacked was the service...the people never really came by often. We think it was the worst service we had in our 5 days in London. Typically, we Americans are treated well since we tip well. But our waiter came over maybe twice our whole meal. As a matter of fact, they left us sitting there so long that we ended up getting hungry enough for dessert. I had the Banana Tres Leches and Kevin had the Chocolate Truffle Cake. Both were delicious although the Chocolate Truffle Cake came with a "créme fraiche" which Kevin and I thought was whipped cream on the plate...but turned out to be sour cream.

Posted by

Erik Burckart

at

7:51 AM

0

comments

![]()

![]()

Saturday, March 01, 2008

Anna in a box

Early this morning Anna was dragging around an empty diaper box destined for the recycling bin, but I wasn't sure what she wanted to do with it. First, I put her in the box to see if she liked it. She sat down and was just so happy in her box. So, I cut one side of the box so she could go in and out. Within minutes she had her stuffed animals, Sammy the bear and her bunny, in the box with her enjoying their new accommodations. Before she stopped playing with the box, she closed it back up just as she likes to close doors.

Posted by

Erik Burckart

at

8:26 AM

0

comments

![]()

![]()

Labels: Anna