If you are in debt or your are struggling to manage your finances, Dave Ramsey is coming to Raleigh for his Total Money Makeover event. Those who read this blog know that we follow the teachings as learned through Crown Financial Ministries. Dave's plan is an offshoot of that plan and his one size fits all plan is great for anyone struggling with debt or finances.

If you don't know how you will dig out of your mess or need a plan and encouragement to do so, please consider going....based on the many people I know who have gotten out of debt on Dave's plan - I think you will be blessed by it.

Friday, July 30, 2010

In Debt? Dave Ramsey coming to Raleigh

Posted by

Erik Burckart

at

8:17 AM

0

comments

![]()

![]()

Tuesday, July 27, 2010

Twist on daily cost of debt - the giving possibility

When thinking about how to chronicle life in the future, I decided to peruse the blogosphere for for debt free living blogs. I found this interesting blog not about living debt free (yet) but about achieving freedom from debt called Debt Free Adventures...which just so happened to be one of the site names I had thought of...

All that intro to bring you to an interesting blog that Matt wrote here entitled How Much Our Debt Costs where he records that his debt costs $37/day. This took me back to a comment by a friend that stated that he paid roughly $10,000 in interest and was able to get about $3200 back on that through state and local tax deductions. What that made me realize is that $10,000 in interest is about $27.40/day or $18.63/day if you count the money saved on taxes.

Whats amazing is that if you took that $10,000 you could sponsor 25 kids all year long, deduct the money on your taxes, and still have extra money in your pocket. Is anyone else amazed by that? Have you figured out how much your debt costs and what you would or could do with that? What else could you be doing with $25/day or whatever your daily cost of debt is?

Posted by

Erik Burckart

at

6:01 AM

2

comments

![]()

![]()

Monday, July 26, 2010

Paying off your mortgage will lower your credit score

A while back I was researching what happens when you pay off your mortgage. One of the things I stumbled on was this helpful blog in which the author shares his experience that his FICO credit score went down based on paying off his mortgage:

I’m no FICO credit score expert, but my understanding is that the decrease occurred because I no longer have any installment loans. Apparently their algorithms aren’t smart enough to distinguish between people who’ve never had an installment loan and people who’ve had one, never made a late payment, and paid it off within the past month.

Is it that their algorithms aren't smart enough or are they working as designed? Dave Ramsey calls the FICO credit score two things:

The I Love Debt Score

The "I've been kissing the bank's butt on a regular basis" score

That's right, its probably working as designed. Someone who pays off their mortgage isn't as good as someone who will pay interest on debt consistently to a bank. Its common sense and business wise for the bank. But how should consumers react?

I am writing this quick blog because I think people should know about this and be outraged. We should be outraged because your credit score is being used for other things while the algorithm is written for the bank's customer evaluation purposes. That is the most outrageous part of this. Insurance companies and (reportedly) some employers will look at it to determine the risk of an individual. The good news is that some insurance agencies don't use the raw credit score. From my insurance company's website on "insurance scoring":

How does an insurance score differ from a financial credit score?

When evaluating a person’s credit information to determine an insurance score, an insurer only considers those items from credit reports that are relevant to insurance loss potential. Both an insurance score and a credit score are derived from the same thing: a credit report; but they are distinctly different.

The main difference between an insurance score and a credit score is that insurance scores do not take into account a consumer’s income. Unlike a mortgage company, an insurance company is not assessing a customer’s credit-worthiness and therefore doesn’t consider income. Instead, an insurance company only considers those items on a credit report that will indicate future loss potential.

We recognize that people sometimes face difficult circumstances in their lives such as job loss, medical bills or divorce. When we consider an applicant’s insurance score, an isolated instance of a late payment will not have a significant impact on your eligibility. We are looking at long-term patterns and overall responsible use of credit.

Similarly, applicants who use cash for purchases or who don’t have established credit will not be scored negatively.

We should demand anyone aside from banks never use the credit score. If they use the credit report, so be it. But Should paying off your house make you more risky to insurance companies or employers? No! The only reason paying off you house makes you more risky is that you can, to a certain extent, do more of what you please. ;-)

Posted by

Erik Burckart

at

7:52 AM

1 comments

![]()

![]()

Sunday, July 18, 2010

Millennial Generation Equivalent to Mortgage Burning Parties

I've been thinking about what is the Millennial generation's (born in the 1977-1982 and beyond range) equivalent to a mortgage burning party. As I did research, I found this informative blog summarizing the tradition of mortgage burning parties in the past (with quotes from the LA Times) and why that is being lost through generations. But, people are still asking for good ways to celebrate being rid of their mortgage. So, if the articles are right and many of the Boomer and Generation X generations will never lose their debt, will the Millennial generation be any different?

I tend to be an optimist but the Millennial generation seems to be in a bad debt position as of now. This article from the Futurist says:

Debt levels for the Millennial Generation are totally out of control. Before many Millennials even reach the age of 25, they’ve racked up enough debt to equal all their income for the next five or ten years, and it will take nearly a lifetime to pay off. So much for going to college to get ahead.

If that is the case, will they ever get to the point where they pay off their mortgages? Optimistically, I see this generation as people that are anti-debt because many of them have been burdened by this large debt from a very young age.

I think we are seeing more and more people that are anti-debt at 25. You can even see this in some of the new up and coming "online personalities" like Shaycarl(on right) are anti-debt. On the flip side, this generation has few people to look up to who have paid off their mortgages at young ages and maybe they won't even think that the mortgage is something to pay off.

I think we are seeing more and more people that are anti-debt at 25. You can even see this in some of the new up and coming "online personalities" like Shaycarl(on right) are anti-debt. On the flip side, this generation has few people to look up to who have paid off their mortgages at young ages and maybe they won't even think that the mortgage is something to pay off.For those like me who are anti-debt, I think this calls for a new way to celebrate paying off your mortgage to make sure people know it can be a cool accomplishment to paying off your mortgage. A mortgage burning party seems too easy.

I am thinking of creating a model rocket out of the paperwork and launching it in a way that it will explode. Pretty sure that is illegal in North Carolina though, so I may have to travel to South Carolina where they let you launch anything. :-)

I am thinking of creating a model rocket out of the paperwork and launching it in a way that it will explode. Pretty sure that is illegal in North Carolina though, so I may have to travel to South Carolina where they let you launch anything. :-)So the rocket idea may not work, but I am looking for other ideas. How do you think the Millennial Generation should celebrate paying off their mortgages? Is there something we can do which will be not boastful but help our peers know it is possible to pay off your mortgage and not just a dream that happens if you can stay in one place for 30 years?

Posted by

Erik Burckart

at

8:57 AM

0

comments

![]()

![]()

Tuesday, July 13, 2010

How to deal with your email being hijacked

Last night I received an email question from a financial advisor. Heather asked me if I planned to fill it out and email it back to which I responded no, public email like gmail isn't secure. Little did I know I would wake up and experience that first hand. This morning I started at the gym around 5 AM and got back home about 6:10 AM. I sat down an cracked open my laptop a little while later to see over a hundred unread messages bounced emails.

I quickly realized my email address was being hijacked. The first thing I needed to figure out was whether someone was spoofing my email address (think of it as someone putting the return address on an envelope to be your address rather than their address) or had they hijacked my gmail account. I looked and saw familiar addresses being bounced back to me, letting me know that someone had hijacked my account specifically.

Within 5 minutes after figuring this out I had locked them out of my account, 14 minutes since they began. They sent hundreds of emails in that time but I don't think they would have had the time to reset my banking passwords or other important information. What I realized was that I should write a simple guide to how to lock out the hijackers for my friends and family since this is happening with increasing regularity.

Here is what to do if you suspect your Gmail is being hijacked:

1. Immediately change your password. Go to http://google.com/accounts and change your password. This locks out most basic scripts (thanks to the lack of Cookie support) or anyone using POP/IMAP. Don't spend a lot of time thinking of a new password, use your old password with a number at the end or your address. You can make a stronger password later - right now you are just trying to stop the script.

2. Next, check and see if you need to log anyone out. To do that, go to bottom of your email and click on the details of the last account activity:

You will see a popup with a button at the top that says Sign out all other sessions. Click that immediately.

You can see the China address which was my hijacker. The emails stopped once I changed my password which means he probably was running a script of some sort but I clicked Sign out all other sessions to make sure.

3. Check your Gmail settings for changes. My hijacker set my vacation responder to respond to every email with some message.

4. Check your machine for spyware. They may have gotten your password through spyware. Also, check the URLs you log in to your email through to make sure they didn't do some URL hijacking which allowed them to capture your password.

Update 7/13/2010 11:30 AM: Google's help page on suspicious activity itself lists some spyware checkers.

5. Finally, change your password to something strong again. Log out, and log back in.

So, how can the hijackers get to your email? Here are a couple of ways:

1. Packet sniffing - we often send our google passwords over http (not https) which means that they are essentially in the clear for people to see as they pass over the internet. They may also try to grab your cookie and make it look like they are you through packet sniffing.

2. Bad web page exploits. This could be what they call cross site scripting (XSS) or any number of other attacks to steal your password.

3. Spyware. Spyware on your machine can capture keystrokes or packets.

4. Other sites that store your Gmail password get hacked and lose your data.

5. Gmail exploits (doubtful). If there was some exposure on Google's servers, they could use this to log in.

6. Password crackers (even more doubtful). Only really works in movies :-)

Update: 7/13/2010 11:30 AM

Four hours later, Google notified me that I had suspicious activity on my Gmail. I am glad they caught it even if it was 4 hours after I had caught it.

Posted by

Erik Burckart

at

7:35 AM

4

comments

![]()

![]()

Monday, July 12, 2010

will drive to talk

I am writing this real quick while in the parking lot of kid's exchange, a big local consignment deal, waiting for heather to drop off some clothes she is selling. I am sitting in the parking lot because the 35 mins it took us to drive down here was valuable time where Heather and I could actually talk. So, I will take a long car ride with her merely to have the opportunity to talk to her longer. Anyone else experience this?

Posted by

Erik Burckart

at

6:01 PM

0

comments

![]()

![]()

Sunday, July 11, 2010

Bush tax cuts expiring will affect you!

This (shouldn't be) just in - Bush's tax cuts put more money in your pocket! Based on the normal readers of my blog, this is a fairly safe statement to make. These tax cuts expiring will mean you will be paying more money to the federal government. I have said this to many people and people continually had accused me of being far right or fear mongering - but you can read a good in depth article here at Yahoo! Finance courtesy of the Wall Street Journal's SmartMoney. Here are some of the top ways you will be paying more, quotes from the aforementioned article when possible:

1) Higher tax brackets for all. "The current six rate brackets of 10%, 15%, 25%, 28%, 33% and 35% will be replaced by five new brackets with the higher rates of 15%, 28%, 31%, 36% and 39.6%." Your first dollars will be taxed at a higher bracket. You can see the tax brackets here at MoneyChimp. The 10% tax brackets currently covers the first $8375 for singles and $16750 for married filing jointly. Thats immediately another $400 for single and $800 for married couples just for the first tax bracket.

2) Higher capital gains and dividend taxes. "Right now, the maximum federal rate on long-term capital gains and dividends is only 15%. Starting next year, the maximum rate on long-term gains will increase to 20%. The maximum rate on dividends will skyrocket to 39.6%." "Right now, an unbeatable 0% rate applies to long-term gains and dividends collected by folks in lowest two rate brackets of 10% and 15%. Starting next year, those folks will pay 10% on long-term gains and 15% and 28% on dividends (compared with 0% now) unless a change is made. "

3) The end of many more specific fixes to the tax code. The marriage penalty comes back. Itemized deductions and personal exemptions. begin to be phased out again for higher income individuals. You can check out the article for more specifics.

I hope this helps you understand better that we all used to benefit from these tax breaks and losing them will hit all of our wallets. I hope that it doesn't affect YOUR budget too much!

Posted by

Erik Burckart

at

7:53 PM

0

comments

![]()

![]()

Siblings and best friends?

My sister is one of my closest friends which is odd considering we are four years apart and haven't lived near one another in over 15 years. For years I had wished we were closer in age so that (I thought) we could be better friends. Realistically what that means is I had an (possibly unrealistic) expectation that we could have kids very close in age who would be best friends. I pictured them skipping through the grassy meadow on a nice sunny day....

Our girls often are 18 months apart and close friends and have yet to act as bitter enemies at any point. They help each other in life. Madelyn is Anna's security - Anna is comfortable often so long as her sister is near. Anna is Madelyn's teacher and sometimes her second mommy - Madelyn learns from Anna and is comforted by Anna. That why I love this picture we snapped of them yesterday (that I altered above) - it shows the fun they have together even when just posing for pictures for their daddy. My prayer is that this is how it will always be.

Posted by

Erik Burckart

at

2:10 PM

0

comments

![]()

![]()

Thursday, July 08, 2010

Planning for your worst moments

Seven years ago when Heather and I got married, we were two independent people trying to learn to live together. Today, we work together in a much different way. When I am rash, she is well thought out. When I am disorganized, she has a checklist. When I am tactless, she is graceful. When I am arrogant, she humbles me ;-). It doesn't always work this way, some times she is rash (maybe twice in our marriage) and I am well thought out. She is my compliment and we are dependent on one another's natural talents and abilities now.

I found myself uttering a similar pitch recently when talking to a friend about estate planning. If you are in any way like me, estate planning is crucial because if anything happens to your spouse you will be out of alignment. A Heather-less Erik would be lost in so many ways. Many of those ways, Heather is the only one who knows. For example, Heather is the bill payer in the household. Do I even know how or when I am supposed to pay which bills? If you aren't the bill payer, do you know? But, I worry more about an Erik-less Heather. I want to make sure this woman I love so much is okay and taken care of. How do I do that?

A lot of people don't even know where to start with estate planning. Most people believe that some life insurance is enough estate planning. Others go further but stop at a will. The reason I write this is that its not enough. You should have all the information your spouse would need should you pass away. Account numbers, passwords, budgets, bill payment schedules, life insurance, health care information - anything that your spouse can need. Then, if you both have put that information together, look at it and see if it is enough for the person you willed you children and/or possessions to if something happens to both of you. Put it all in a fireproof safe or safety deposit box. Update it (this is where we have failed) yearly.

I can't state how important estate planning is. Your death will be the worst moments of your spouses life. If you and your spouse die, it may be the worst moments of your child's life. A little bit of planning can make those more bearable.

There are many biblical references to estate planning. Perhaps first mentioned here in Genesis 25:5-6 where Abraham had prepared his estate:

5 Abraham left everything he owned to Isaac. 6 But while he was still living, he gave gifts to the sons of his concubines and sent them away from his son Isaac to the land of the east.

James 1:27

Religion that God our Father accepts as pure and faultless is this: to look after orphans and widows in their distress and to keep oneself from being polluted by the world.

1 Timothy 5:8

If anyone does not provide for his relatives, and especially for his immediate family, he has denied the faith and is worse than an unbeliever.

I also found this to be an interesting article on biblical estate planning.

Posted by

Erik Burckart

at

7:27 AM

0

comments

![]()

![]()

Labels: Estate planning

Wednesday, July 07, 2010

Inspirational Art - beyond Hallmark

I was looking for an inspirational picture and I decided I would start with a simple Google search. What I found was an awesome story about a woman, Julie Chen, who is a stay at home mom and makes some art that I just absolutely love. I first stumbled upon Julie's Etsy store, Life Verse Design. For those that don't know Etsy, think of it as a massive consignment store on the web. They allow people to sell their homemade, vintage, and unique gifts to the world through the Etsy store.

I immediately loved Julie's art and thought I would do some more research before I bought it. I then stumbled on to her blog, which tells much more of the story of this inspirational stay at home mom that first created her art as an act of worship, found her way to selling a couple designs as a church craft show, started an etsy store in 2008, and now has her own line of DEMDACO art. DEMDACO is the brand that sells the very popular Willow Tree Collection that you will find at many small eclectic stores and Hallmarks around the country.

After finding that no where in the Triangle (Raleigh-Durham-Chapel Hill for you outsiders) area sells Julie's DEMDACO Collection AND she didn't have my favorite pieces in DEMDACO yet, I decided to buy some prints from her Etsy store and frame them for now. After I bought them I had the unique experience of emailing back and forth with Julie who is obviously a wonderful and genuine woman who is passionate about her art and very friendly as well. Please go and check out her collection and support Julie Chen's art.

Posted by

Erik Burckart

at

8:24 PM

0

comments

![]()

![]()

Monday, July 05, 2010

Beyond tithing - sharing God's blessings

I have been thinking and praying about what it means to be a good steward of our money and share the abundant blessings we have been given. I have a heart for giving and have read many things on the subject. If you are ever looking for giving and tithing articles, Crown financial ministries has a great set.

Beyond the tithe, we should still be looking to sharing God's blessing. Here are some verses I have been spending time reviewing regarding what it means to share our blessings and what are we called to do. Here are some of the verses I have come up with:

Luke 16:9

I tell you, use worldly wealth to gain friends for yourselves, so that when it is gone, you will be welcomed into eternal dwellings.

Matthew 25:34-40

34 "Then the King will say to those on his right, 'Come, you who are blessed by my Father; take your inheritance, the kingdom prepared for you since the creation of the world. 35 For I was hungry and you gave me something to eat, I was thirsty and you gave me something to drink, I was a stranger and you invited me in, 36 I needed clothes and you clothed me, I was sick and you looked after me, I was in prison and you came to visit me.' 37 "Then the righteous will answer him, 'LORD, when did we see you hungry and feed you, or thirsty and give you something to drink? 38 When did we see you a stranger and invite you in, or needing clothes and clothe you? 39 When did we see you sick or in prison and go to visit you?' 40 "The King will reply, 'I tell you the truth, whatever you did for one of the least of these brothers of mine, you did for me.'

Luke 12:22-34

22 Then Jesus said to his disciples: "Therefore I tell you, do not worry about your life, what you will eat; or about your body, what you will wear. 23 Life is more than food, and the body more than clothes. 24 Consider the ravens: They do not sow or reap, they have no storeroom or barn; yet God feeds them. And how much more valuable you are than birds! 25 Who of you by worrying can add a single hour to his life ? 26 Since you cannot do this very little thing, why do you worry about the rest? 27 "Consider how the lilies grow. They do not labor or spin. Yet I tell you, not even Solomon in all his splendor was dressed like one of these. 28 If that is how God clothes the grass of the field, which is here today, and tomorrow is thrown into the fire, how much more will he clothe you, O you of little faith! 29 And do not set your heart on what you will eat or drink; do not worry about it. 30 For the pagan world runs after all such things, and your Father knows that you need them. 31 But seek his kingdom, and these things will be given to you as well. 32 "Do not be afraid, little flock, for your Father has been pleased to give you the kingdom. 33 Sell your possessions and give to the poor. Provide purses for yourselves that will not wear out, a treasure in heaven that will not be exhausted, where no thief comes near and no moth destroys. 34 For where your treasure is, there your heart will be also.

Luke 14:12

12 Then Jesus said to his host, "When you give a luncheon or dinner, do not invite your friends, your brothers or relatives, or your rich neighbors; if you do, they may invite you back and so you will be repaid. 13 But when you give a banquet, invite the poor, the crippled, the lame, the blind, 14 and you will be blessed. Although they cannot repay you, you will be repaid at the resurrection of the righteous."

From those passages I get that its not only in obedience that we give our first tithe back to God but that we view the rest, the remaining 90%, as money he has blessed us with that should also bless others. We should take these blessings and use them to help others which are things with eternal consequences often instead of things which are of short consequence. I don't have many other brilliant revelations yet, but I'll finish this by paraphrasing part of Matthew Henry's commentary on Luke 16:9 which I found insightful:

Our Lord Jesus here exhorts us to provide for our comfortable reception to the happiness of another world, by making good use of our possessions and enjoyments in this world. [...] It is the wisdom of the men of this world so to manage their money as that they may have the benefit of it hereafter, and not for the present only; therefore they put it out to interest, buy land with it, put it into this or the other fund. Now we should learn of them to make use of our money so as that we may be the better for it hereafter in another world, as they do in hopes to be the better for it hereafter in this world; so cast it upon the waters as that we may find it again after many days, Eccl. 11:1. And in our case, though whatever we have are our Lord’s goods, yet, as long as we dispose of them among our Lord’s tenants and for their advantage, it is so far from being reckoned a wrong to our Lord, that it is a duty to him as well as policy for ourselves.

Posted by

Erik Burckart

at

1:55 PM

0

comments

![]()

![]()

Sunday, July 04, 2010

Blueberry Picking at Herndon Hills Farm

Yesterday we had a fabulous time blueberry picking at Herndon Hills Farm in Durham, NC less than a mile from Southpoint mall. I should start by saying I had no idea there were local places to blueberry pick in NC. About 2 weeks ago, Anna began asking if we could go blueberry picking. On Friday, I happened to ask one of the ladies at the gym what she was up to this weekend and she said she was going blueberry picking. Needless to say, we were in and actually even saw her there.

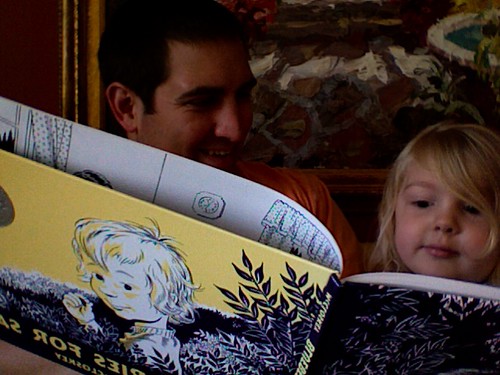

First, why did Anna want to go blueberry picking? It has everything to do with a book called Blueberries for Sal. Anna and I read it often.

Once we got there, we got a couple of buckets with bags in them. The farm had both blueberries and blackberries to pick. I was told they had like 4 types of blueberry bushes there you could pick from. Also, several websites indicated that Herndon Hills is an organic farm but I didn't confirm. Both blueberries and blackberries cost $2.75/lb there.

Anna enjoyed picking them and nibbling on a few herself.

Madelyn (2 years, 2 months old) immediately understand how to select which blueberries to pick and really was wonderful at it.

In the end, we spent 40 minutes and had less than 2 lbs of blueberries and blackberries. It takes as long to pick a blueberry as it does a strawberry - and you need a lot more blueberries. It was a great time.

Posted by

Erik Burckart

at

12:34 PM

0

comments

![]()

![]()

Digital Photographers for the Millennial Generation

In the past couple of weeks I have realized how much the photography industry must be hurting. Cameras are getting cheaper and through easy editing and the ability to take hundreds of pictures without consequence, people are starting to question the need for photographers. I think this should cause photographers to rethink their business but it doesn't seem to be actually happening. I think as my generation becomes a higher percentage of the buyers that photographers will be forced to change or become like travel agents, a very niche profession which is tough to make a living off of.

When I was born, my family was having photos captured as slides and slowly moved to prints. About five years ago, my father embarked on an adventure to scan all the important family photos when he realized that digital photos were what he needed to pass down to his children. While we and many others have prints around the house, its the digital photos which are the real high value items that we want to keep around. So, how does a photographer that hopes to make his/her money off prints and doesn't sell digital photos hope to make money when myself and my friends put their long term value in digital photos and not prints?

I was confronted with this recently when my wife won a family photo session from a local photographer. Afterwards, we asked simply how much it would cost for some of the photos as digital prints and they stated that they were not for sale as digital prints. To put it bluntly, this was preposterous to me. The only thing that has real long term value to me is the digital photos and, if they don't share my strong convictions about copyright protection, all their customers will scan the photos they sell them to digitize them. Prints have little to no value to me and in the end they received a lot less money then I would have been willing to spend because of this absurd position.

Having thought about this a bit, I did some research into what other photographers are doing. Here is a good blog about a new pricing model for digital photos where the photographer charges per photo he sells, relying on his skills to make attractive photos that his audience will want to purchase. He also points out in the comments that another variant of this which relies less on choosing the right clientele is to charge an up front fee and include some number of digital photos in that up front fee. That up front fee would then guarantee that the photographer is compensated for their time.

I think this latter model, paying for the photo session but receiving all digital photos, is a reasonable model and it is what I will demand out of any photographer I pay in the future. I see no reason to pay extraordinary amounts for prints which I view as having a limited lifetime. Based on conversation with many friends, I feel that many people in my generation feel the same way. If I understand my generation at all, photographers may need to change how they make their money and assume they will be selling the digital rights to photos rather than prints.

Posted by

Erik Burckart

at

11:50 AM

0

comments

![]()

![]()